For more than 75 years, Pacific Cross International has been a pioneer in providing health, personal accident, and travel insurance to clients across Asia. Over this time, the company has grown from its humble beginnings to become a trusted name in the insurance market, serving clients from 90 nationalities in 43 countries. Pacific Cross is committed to offering personalised and accessible insurance solutions that meet the needs of its customers, no matter where their journey takes them.

A rich history of growth and expansion

The journey of Pacific Cross began in 1949 when it was initially founded as State Bonding and Insurance Company, Inc. From these early years, the company gradually built its reputation in the insurance industry, recognising the need for better health coverage and eventually creating a medical insurance division in 1977 to meet this demand. By 1986, Pacific Cross had rebranded as Blue Cross Insurance, Inc., focusing on medical, personal accident, and travel insurance. This shift marked the company’s commitment to the growing health insurance sector, a move that would set the stage for its future success.

However, the most significant change came in 2015, when Pacific Cross took a bold step forward by rebranding once again, this time to Pacific Cross, aligning itself with its regional partners in the Pacific Cross Group. This strategic shift allowed the company to strengthen its collaboration with sister companies across Asia and create a more integrated network that could deliver insurance solutions that were not just regional but also global in their scope. The rebranding also positioned Pacific Cross to leverage the opportunities arising from ASEAN integration, allowing the company to expand its reach and services to better serve the needs of an increasingly mobile and connected world.

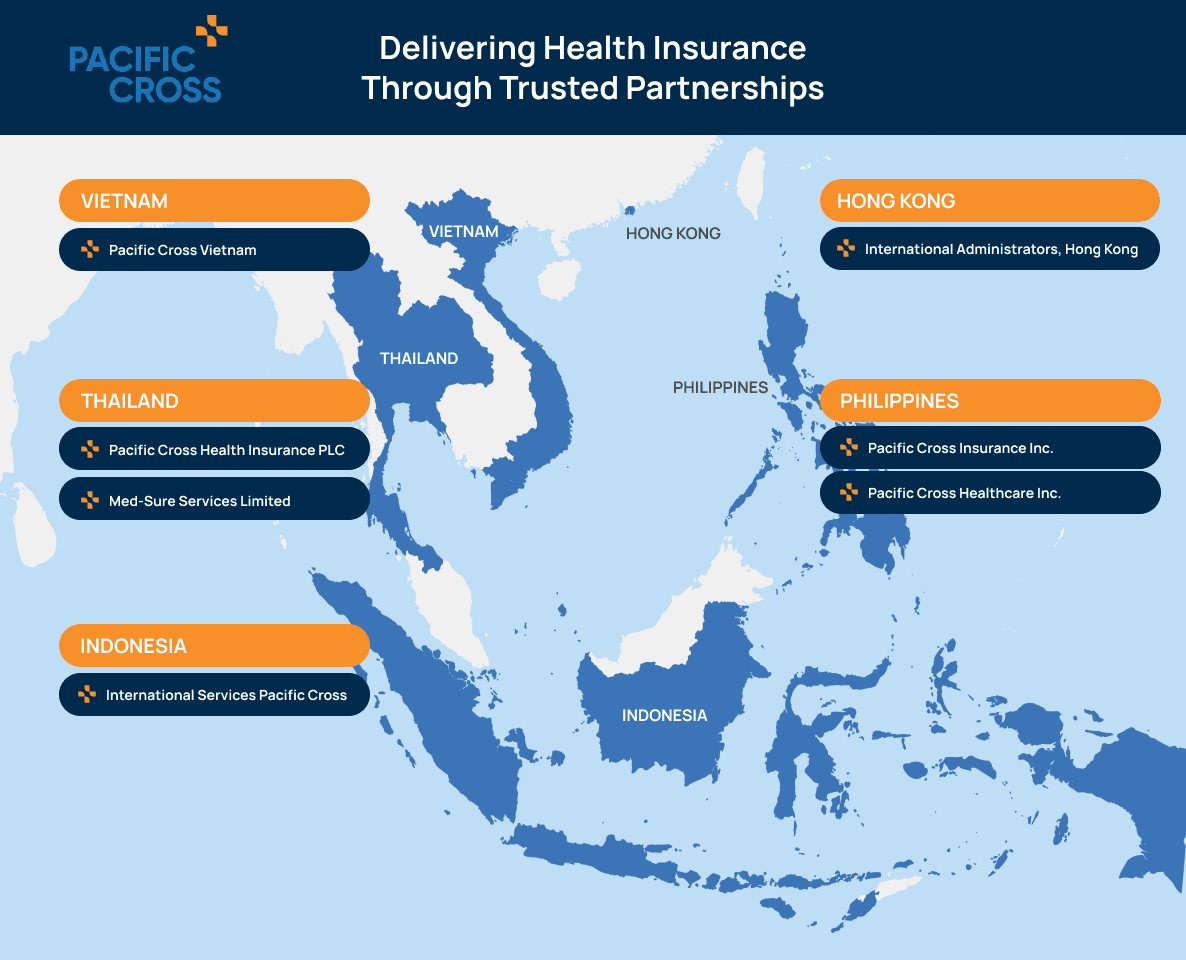

Over the years, Pacific Cross has extended its reach to several countries, establishing offices in Hong Kong, the Philippines, Thailand, Indonesia, and Vietnam. Through these offices, Pacific Cross has built a network of trusted hospitals, medical clinics, and healthcare professionals to provide comprehensive support for medical emergencies and healthcare needs across the region. Today, Pacific Cross provides coverage for over 1.5 million travellers, totalling more than 5 million travel days annually. This extensive coverage ensures that clients are always protected, whether they are on holiday, travelling for business, or living abroad.

A comprehensive insurance portfolio for a changing world

Pacific Cross has always been at the forefront of addressing the evolving insurance needs of its clients. The company’s range of offerings includes health insurance, personal accident insurance, and travel insurance, with solutions tailored to the specific needs of individuals, families, and corporate clients. Pacific Cross understands that the world is increasingly interconnected, and the demand for international insurance solutions is growing. That’s why the company offers global protection, ensuring that clients are covered wherever they are in the world.

One of Pacific Cross’s key strengths lies in its ability to offer insurance that goes beyond basic coverage. The company’s philosophy is simple but powerful: “More than just insurance.” For Pacific Cross, this means providing peace of mind, ensuring that clients are not only protected financially but also supported throughout their journeys, whether it be through medical assistance, emergency services, or customer support. The company’s slogan, “More than just insurance. Pacific Cross provides peace of mind”, reflects its mission to provide customers with not just coverage, but the guidance and advice they need to make informed decisions about their health and well-being.

Pacific Cross has built a reputation for offering international protection that is tailored to each customer. The company offers a variety of health insurance plans, with coverage amounts of up to THB 50 million per patient per stay, ensuring that clients have access to the best care when they need it most. Additionally, Pacific Cross provides Schengen-accredited travel insurance, which offers robust protection for both domestic and international journeys, giving travellers the security and confidence to explore the world without worry.

In each country where Pacific Cross operates, the company has partnered with an extensive network of hospitals, medical clinics, and local healthcare professionals to ensure seamless access to medical services. Whether clients are in need of routine care or emergency treatment, Pacific Cross’s network is designed to provide assistance and support wherever they are. This extensive network ensures that clients receive the best possible care, regardless of their location.

The focus on health and wellness

Pacific Cross is not just about providing insurance—it’s about promoting health and wellness. In recent years, the company has focused on delivering a more comprehensive approach to health insurance by encouraging healthier lifestyles among its clients. Through various health promotion initiatives, Pacific Cross has provided discounts on health check-ups, launched telemedicine services, and introduced fitness collaborations to support the well-being of its customers. These initiatives align with the company’s commitment to improving the health of its clients and providing them with the tools they need to live healthier lives.

Moreover, the company has launched several initiatives aimed at promoting healthy eating, including access to wellness programs and resources that guide customers in making healthier choices. By incorporating health and wellness into the insurance experience, Pacific Cross has created a more holistic approach to insurance, helping customers stay healthy while offering financial protection.

Strategic leadership and vision for the future

Pacific Cross’s success is also driven by strong and visionary leadership. At the helm of the company is Dr. Bui Minh Mai Khanh, the Chief Executive Officer of Pacific Cross Health Insurance PCL. Under Dr. Khanh’s leadership, the company has embraced new strategies focused on customer satisfaction, strategic growth, and operational excellence. Her approach has led to continuous improvement in the customer experience and the company’s ability to stay ahead in an ever-changing industry.

In a recent statement, Dr. Khanh expressed her commitment to the company’s future, saying, “Our success is a testament to our dedication to innovation, customer-centric services, strategic growth initiatives, and strong partnerships. As we advance to the next level, we remain committed to enhancing the customer experience and solidifying our position as a leader in Thailand’s health and travel insurance industry.” Under Dr. Khanh’s leadership, Pacific Cross has been able to maintain a strong market presence while adapting to the needs of an increasingly diverse and dynamic customer base.

Dr. Khanh’s vision for the company emphasises continuous growth and an unwavering commitment to the needs of customers. As Pacific Cross looks to the future, the company is well-positioned to continue expanding its reach, building strong partnerships, and delivering top-quality service to clients across Asia. The company’s focus on innovation and customer-centricity ensures that it will remain a leader in the health and travel insurance space for years to come.

In this exclusive interview with Women’s Tabloid, Dr. Bui Minh Mai Khanh shares her leadership journey, the key factors behind Pacific Cross’s growth, and the company’s commitment to innovation and customer satisfaction in the evolving health insurance landscape.

Pacific Cross has seen impressive growth over the years. What do you think has been the key factor driving this success?

Our growth at Pacific Cross has been driven by a clear strategic vision, a commitment to customer-centric solutions, and ongoing investments in our intermediaries, people and technology. By prioritizing a deep understanding of our diverse clientele and leveraging data-driven insights, we have established a strong foundation that enables us to continually innovate and meet the ever-evolving landscape of our industry.

As a leading health insurance provider, we understand the critical importance of being there for our policyholders when they need us most. This commitment drives our focus on delivering exceptional customer service, starting from the moment a policy is purchased to when medical assistance is required. By leveraging our extensive expertise and market insights, we have built strong relationships with our distribution partners and clients,

who trust our proven track record and internal capabilities in providing reliable health insurance solutions. This approach has solidified our position as a market leader.

In recognition of our rapid yet sustainable growth, we are proud to have received the prestigious 2024 ‘Best Health Insurer in Thailand’ award from Insurance Asia. We see our recent success not as a final milestone, but as a stepping stone toward further growth and innovation. Our focus remains on pushing the boundaries of product development, advancing operational excellence, ensuring financial stability, refining risk assessment strategies,and consistently delivering value to all our stakeholders.

How do you envision the future of the health insurance industry in Thailand, and how is Pacific Cross positioning itself to stay ahead of these changes?

The health insurance industry in Thailand is undergoing rapid transformation, influenced by advancements in medical technology, shifting customer expectations, unprecedented post-COVID-19 global medical inflation, regulatory changes, government programs, and evolving residency requirements. Additionally, there is an increasing emphasis on preventive care. We anticipate a growing demand for personalized health solutions, seamless digital experiences, 24/7 accessible customer service, and value-added wellness and incentive programs. Financial instability in risk assessment across the industry has led some competitors to implement significant premium hikes and introduce co-payments for high-cost medical providers. This is where Pacific Cross holds a competitive edge, thanks to our proven expertise in product development, risk assessment, and consistent financial stability.

To stay ahead of these industry changes, Pacific Cross is investing heavily in digital transformation, enhancing data-driven decision-making, and broadening our product portfolio to meet emerging healthcare demands. Operational efficiency remains a top priority, as it is essential for maintaining customer satisfaction and mitigating premium increases. We have already deployed AI-powered technology to streamline parts of our claims process, ensuring faster and more accurate service. In today’s digital landscape, customers expect frictionless transactions via mobile devices, and we are making significant investments in enhancing our digital platforms. Our ultimate objective is to stay ahead of these changes by providing flexible, comprehensive health plans while focusing on advanced digital solutions and continually improving risk assessment strategies to deliver sustainable, high-quality insurance products and services.

In recent years, digital technology has played an increasingly important role in business. Can you share more about how Pacific Cross is evolving digitally to improve customer access and services?

In recent years, digital technology has played an increasingly important role in business. Can you share more about how Pacific Cross is evolving digitally to improve customer access and services?

Digital technology has become a fundamental pillar in how Pacific Cross delivers value to its customers. Recognizing the growing demand for seamless access and efficient service, we have embraced a holistic digital transformation strategy. This includes the development of user-friendly digital platforms, such as an online quotation and application portal, and a mobile app that enables customers to effortlessly purchase policies, connect with experienced advisors, access policy information, submit claims, and track claim status in real-time. We believe the key to success lies in leveraging digital technology to enhance—not replace—the human experience. Health insurance is inherently complex, and providing expert guidance through digital channels ensures that clients receive both convenience and personalized care. These digital solutions significantly reduce administrative workloads, allowing us to focus more on delivering value.

Beyond customer-facing platforms, we have recently introduced AI-powered solutions to optimize internal operations, including claims processing and risk assessment. By automating routine tasks, we are able to accelerate processing times, reduce errors, and consistently improve service quality. Our objective is to offer a frictionless digital experience that aligns with modern customer expectations.

We are acutely aware of the evolving landscape of health insurance, where customers increasingly seek to engage and purchase policies through digital channels.

As such, we are committed to creating intuitive, modern touchpoints that enhance our brand image and fulfill our brand promise.

Moreover, we continue to invest in advanced data analytics to gain deeper insights into customer behavior and preferences, enabling us to offer more tailored products and services. This data-driven approach not only enhances customer experience but also bolsters our ability to maintain financial stability and competitive pricing.

By prioritizing digital innovation and operational efficiency, Pacific Cross is ensuring that our customers benefit from faster, more reliable, and more convenient health insurance solutions.

Pacific Cross has emphasized customer satisfaction and operational excellence. Can you provide specific examples of how the company is enhancing the customer experience?

At Pacific Cross, delivering exceptional customer satisfaction and achieving operational excellence are central to our mission. We continuously innovate to enhance customer experience by introducing initiatives that improve accessibility, convenience, and service quality. A prime example of this commitment is our ever expanding internal customer service team, which offers 24/7 multilingual support for both Thai and expatriate clients. This ensures that every customer receives clear, personalized assistance when they most need it. Our team undergoes comprehensive and consistent training, emphasizing effective communication with a diverse clientele. High proficiency in English is a core requirement for our representatives to ensure seamless interactions. Additionally, our training programs cultivate a strong “customer-first” mindset, empowering our team to prioritize client needs in every interaction.

To further enhance service, our stringent Service Level Agreement (SLA) guarantees prompt responses to client inquiries, ensuring policyholders can always connect with a customer service representative, day or night. Our advanced internal systems provide real-time updates on claims statuses, giving policyholders clear visibility into the progress of their claims.

We firmly believe that the strength of a health insurance provider lies in its strategic partnerships with medical providers. We take pride in offering cashless treatment through an extensive network of over 550 medical providers across Thailand, positioning us as a leader in the industry in this regard.

These concerted efforts culminated in Pacific Cross receiving the prestigious “Best Customer Service” award from Insurance Asia in 2023, underscoring our dedication to delivering service excellence.

You’ve mentioned the importance of sustainability and social responsibility. How is Pacific Cross incorporating these values into its operations and future strategy?

At Pacific Cross, we are committed to sustainability and social responsibility, integrating these values into both our operations and long-term strategy. One of our key initiatives is our paperless office program, aimed at reducing paper consumption and minimizing environmental impact. By digitizing processes such as policy issuance, claims submissions, and internal communications, we have significantly reduced our reliance on physical documents, contributing to a greener future. During the COVID-19 pandemic, we proactively supported the community by donating food and medical resources to a charity named “Bangkok Community Help.” This initiative provided critical assistance to those in need.

In addition to these efforts, we actively promote preventive health through wellness programs and strategic partnerships with medical providers, encouraging our clients to prioritize their health and well-being. Our wellness initiatives include providing access to comprehensive health screenings. Moving forward, we aim to expand our partnership network to include a broader range of medical providers and enhance the availability of preventive health services.

Furthermore, we are actively pursuing sustainable product development by introducing health plans with integrated wellness options, aimed at promoting preventive care and long-term well-being. Over the years, we have consistently invested in our employees’ health and wellness by offering annual health check-ups, fitness membership subsidies, wellness-focused activities, and fostering a safe, inclusive workplace culture.

By aligning our business practices with sustainable and socially responsible principles, Pacific Cross aims to not only deliver exceptional health insurance solutions but also create a lasting positive impact on the environment and the communities we serve.

Given the company’s diverse customer base, what challenges have you encountered in catering to both Thai and international clients, and how have you addressed them?

Catering to a diverse customer base presents unique challenges due to the varying healthcare and insurance structures globally. Clients from different countries often arrive with differing expectations about how health insurance should function, influenced by their home countries’ healthcare systems. In Thailand, the evolving regulatory landscape and changes in residency requirements have added complexity to health insurance offerings, requiring us to stay agile and continuously adapt our products and services.

One key challenge our customer base faces is the language barrier, especially when dealing with expatriate clients who may not be fluent in English or Thai. To address this, we have built multicultural client advisory and customer service teams with members who are proficient in multiple languages, not only English or Thai. This ensures clear communication and personalized service, allowing us to meet the needs of clients from diverse backgrounds effectively. We recognize that a significant portion of our customer base consists of expatriates, many of whom are retirees who have relocated from other countries. We understand that it is common for these clients to have developed pre-existing conditions over time. To address this specific need, we introduced a product called “Expat Care” in 2024, which provides coverage for pre-existing conditions and offers greater flexibility in selecting zones of coverage.

By embracing diversity, investing in a multilingual team, and continually refining our products to meet regulatory changes and customer expectations, Pacific Cross remains a trusted partner for health insurance in Thailand.

Looking forward, what are your top priorities for the company in the next 5 to 10 years?

How will Pacific Cross continue to differentiate itself in the competitive health insurance market? Over the next 5 to 10 years and beyond, we aim to further establish ourselves as a leading player in Thailand’s health insurance market. Currently ranked as the 3rd largest health non-life insurance provider, our objective is to expand our products and services to reach a broader audience, fostering inclusivity across all customer segments and ensuring accessible medical coverage for all.

Guided by our five company pillars, we consistently translate these strategies into actionable short-term, mid-term, and long-term goals. A customer-centric approach remains central to our growth strategy. We will continue to prioritize the needs of our customers and intermediaries by providing exceptional service, competitive product offerings, and fair pricing.

Receiving the “Best Woman CEO – Health Insurance – Thailand” award from your esteemed publication is an honor, and I am proud to use this platform to advocate for a vision centered on innovation, people empowerment, and customer-centric growth. By nurturing a culture of collaboration and continuous improvement, we are not only shaping the future of Pacific Cross but also advancing the broader mission of making quality health insurance coverage accessible to everyone. Looking ahead, I remain committed to inspiring the next generation of leaders and ensuring our strategies drive sustainable and lasting success.

Pacific Cross’s 75-year legacy of providing comprehensive insurance solutions and peace of mind to millions of customers is a remarkable achievement. From its humble beginnings in 1949 to its current position as a leading provider of health, personal accident, and travel insurance across Asia, Pacific Cross has consistently focused on delivering the best possible customer experience. The company’s global reach, combined with its deep understanding of local markets, allows it to offer tailored solutions that meet the diverse needs of its clients.

As the company continues to expand its offerings and strengthen its network of partners, Pacific Cross remains a trusted and reliable provider of insurance solutions. Through its commitment to health and wellness, innovation, and customer satisfaction, Pacific Cross is well-positioned to continue serving the needs of individuals and families across Asia, offering the security and peace of mind they need, wherever their journeys take them.