Women manage an estimated $32 trillion of global spending, and they are on track to control 75% of discretionary spending worldwide within the next five years. They account for 85% of the purchases globally across consumer markets. These figures demonstrate women’s role and influence on global markets and economies. For businesses, they describe who ultimately determines demand, brand relevance and long-term revenue.

While women’s purchasing power as consumers is dominant, their representation is disproportionately low in leadership roles which directly shape the economy, financial systems and business industries from within. According to the International Finance Corporation, women hold only 11% of senior investment roles in private equity and venture capital firms in emerging markets. Such investment roles decide which companies are funded, scaled or shut out of capital altogether. This imbalance points to a structural disconnect in capital markets: those closest to consumer reality are still largely absent from the rooms where capital is allocated.

The issue is no longer one of representation alone. It is about whether markets are efficiently pricing opportunities.

Why does this matter?

Investment firms shape the economy by deciding where capital flows. Their decisions influence which technologies advance, which business models survive and which markets receive attention. Homogeneity at this level introduces a commercial risk by narrowing the range of perspectives applied to complex decisions.

While statistics have indicated growing representation of women in investment roles, the gender gap persists. This translates into economic losses for investment committees and lost funding opportunities for entrepreneurs.

Capital allocation: Evidence increasingly suggests that diversity in investment decision-making is linked to stronger performance. The IFC found that returns are up to 20% higher at fund managers where women hold between 30% and 70% of leadership roles. The IFC also reported that valuations are 25% higher at portfolio companies with gender balanced leadership. Additional analysis from McKinsey found that limited partners often allocate twice as much (200%) capital to private equity firms with stronger gender diversity.

Institutional investors increasingly scrutinise diversity, equity and inclusion practices when evaluating funds and portfolio companies, reinforcing the direct link between diverse leadership and financial outcomes.

Investment behaviour: The unique patterns and benefits of female investors have been highlighted since a long time. For instance, the 2011 book by LouAnn Lofton, Warren Buffett Invests Like a Girl: And Why You Should Too, which examined the investment style of one of the world’s most successful investors and argued that his patient, long-view approach aligns closely with characteristics often associated with female investors. Lofton’s central point was that successful investors benefit from strategies that many women naturally apply, including careful risk assessment and disciplined decision-making.

Research consistently shows that many female investors trade less frequently, assess risk more carefully and take a longer-term view of value creation. Empirical data supports this view. A study revealed that when VCs increased the number of female partners by 10%, their fund returns increased by 1.5% per year and 9.7% more of their exit were profitable. Women investors are also more likely to consider environmental and social factors as part of risk assessment, broadening the lens through which resilience and downside exposure are evaluated.

For businesses, the relevance is clear: decision diversity affects how risk is priced and how value is sustained over time.

Gender-based funding gap: Despite controlling much of global consumer demand, women-led businesses continue to receive a disproportionately small share of venture funding. Only 2% of VC funds went to female founded startups in the past year. Female-led investments can be a significant solution to closing the finance gap for female entrepreneurs valued at approximately $1.7 trillion.

A US-based study found that venture firms with at least one female partner are 2.3 times more likely to invest in female founders. Firms where women make up at least 30% of partners invest 4.7 times more in female founders than all-male firms. Female angel investors direct roughly 35% of their capital to female founders, while male angels allocate about 13%.

In a market where women hold a majority of the purchasing power, the need to adequately fund female founders and businesswomen is higher than ever. When female founders design products for female buyers, they draw directly on lived experience, sector understanding and insight into the needs and expectations of women as consumers.

A regional view of investment leadership

Patterns of female representation vary sharply by geography. The United States, the United Kingdom and Singapore consistently list amongst the top startup hubs and investment centres in the world. A look at the representation of women in each of these regions’ investment sectors could offer useful signals for global investors and executives.

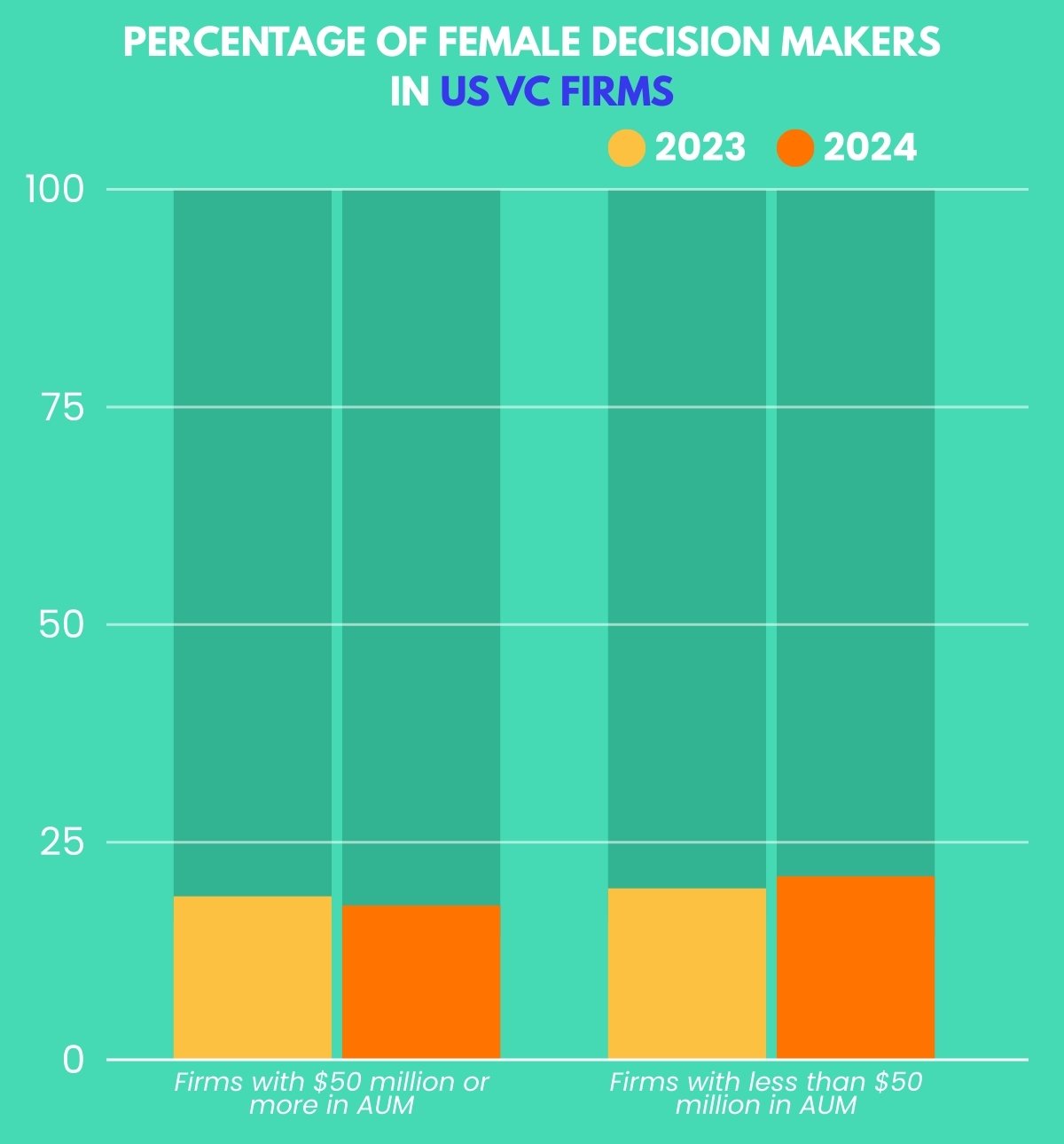

USA: In the United States, women accounted for 17.3% of decision-makers at venture capital firms with at least $50 million in assets under management (AUM) in 2024. This figure has remained largely unchanged from the previous year. At smaller firms that manage under $50 million, women represented 19.5% of decision-makers, rising slightly from 18.8% in the previous year. Although these increases are modest, they indicate steady momentum in smaller firms that often serve as early adopters of diversity.

While the number of female angel investors has fallen to a decade low, collaboration between female angels and female founders has strengthened, reinforcing the importance of early-stage capital in shaping future deal flow. The proportion of deals involving a female founder that included a female angel investor rose to 35% after two consecutive years of decline.

UK and Europe: The UK shows more consistent progress. Women represent 27% of UK-based investment professionals rising from 24% in 2023, and hold 15% of senior roles, compared with 12% in the previous year. Across seniority levels, venture capital firms perform better on gender representation than private equity firms. Women hold 23% of senior roles in VC, compared with 13% in PE. Similarly, at mid-level positions, women account for 36% of roles in VC firms and 26% in PE.

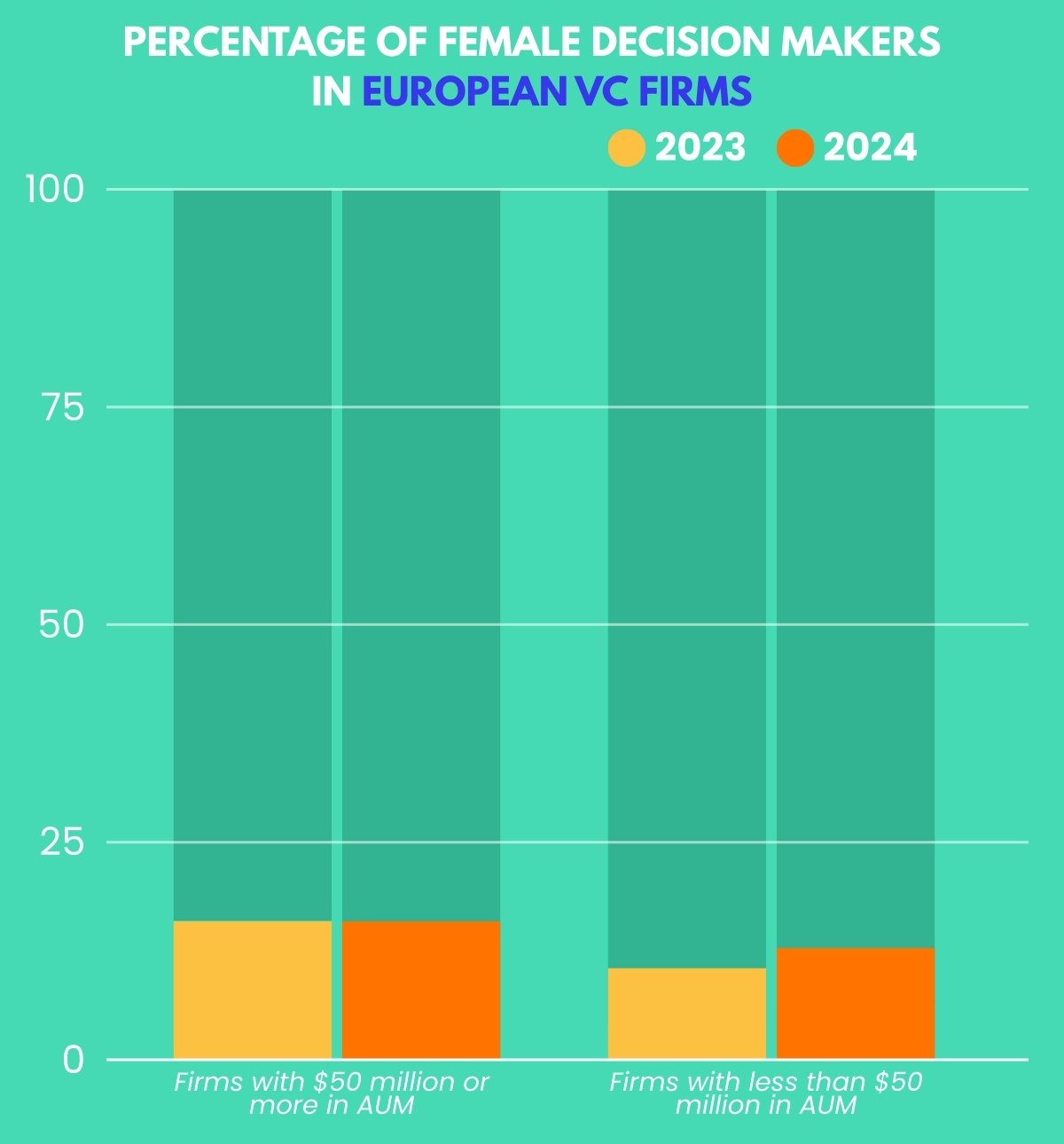

At the European level at large, women represented 15% of decision-makers at firms overseeing at least €50 million in assets in 2024. This is a slight decline from 15.2% in 2023. At firms managing less than €50 million, the number rose to 12.3% from 11.4% in the previous year. Although larger firms employ more female decision-makers in absolute terms, only 8.3% of them have a majority of women directing investment decisions. By contrast, 13.8% of smaller firms have a majority of female cheque writers.

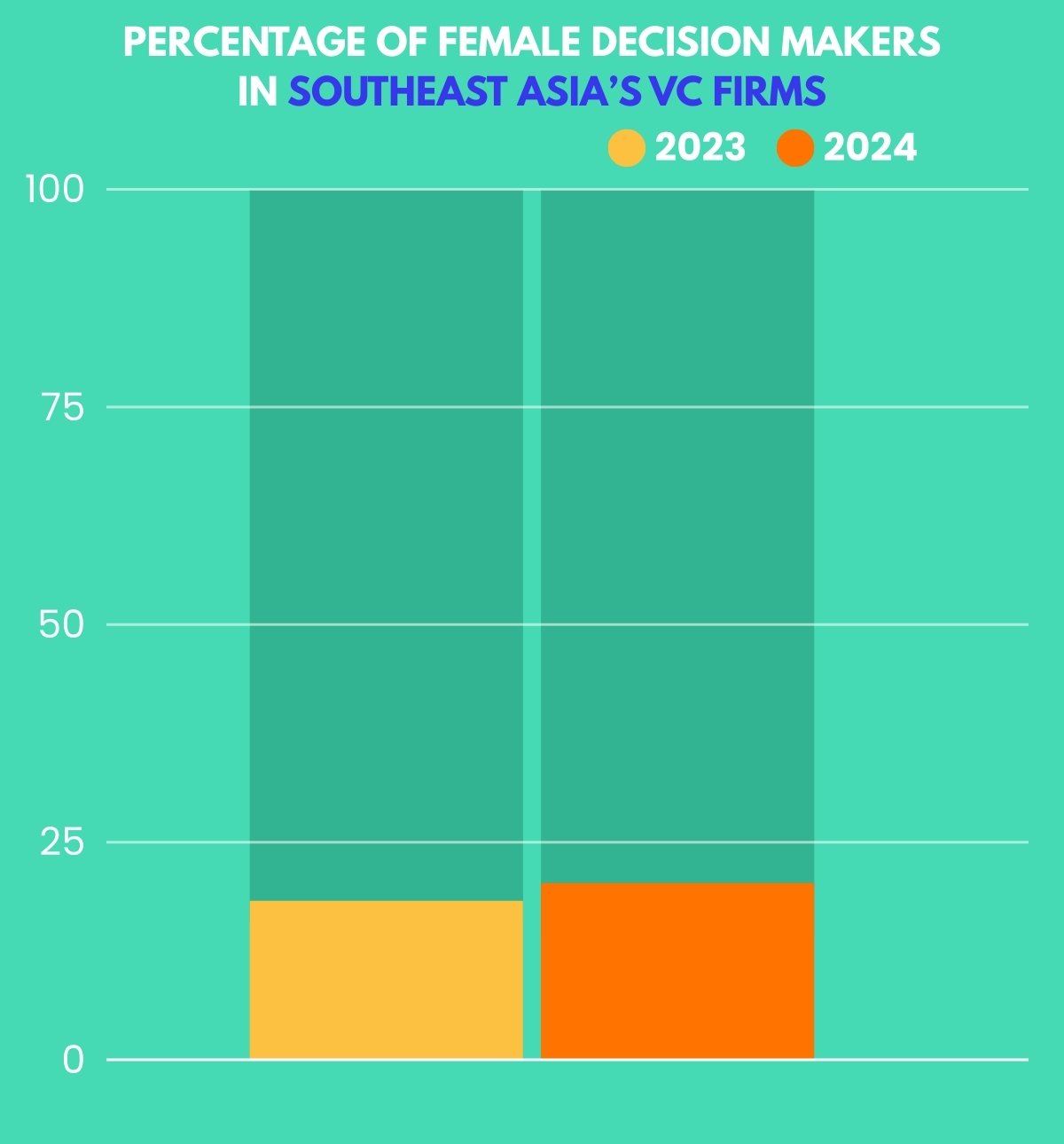

Singapore and Southeast Asia: Singapore stands out markedly within Southeast Asia. The proportion of female investment decision-makers in its venture capital industry rose by 1.6% points over the past year, reaching 34.3%. This is significantly higher than the Southeast Asian average.

Across Southeast Asia-based venture investors, women accounted for 18% of investment decision-makers in 2024. Yet gender diverse private equity teams have consistently raised more capital than all-male teams. Private equity firms with at least one woman in senior investment roles have been reported to raise $29.36 billion across 72 funds since 2020, representing 67.8% of the region’s total private equity capital raised. Although these firms launched fewer funds, they attracted a larger share of capital deployed. In venture capital, gender diverse teams raised 64.7% of the region’s total, equivalent to $14.8 billion.

Across regions, one pattern is consistent: where women are present in investment leadership, capital concentration follows.

Implications for stakeholders

Women’s growing representation in investment firms, the cost of the existing gender gap, the benefits of closing this gender gap and the impact of female investors on the market have layered implications for stakeholders.

For boards, managing partners and institutional investors, gender balance in investment teams should be viewed as a governance issue. Concentrated decision-making increases exposure to blind spots in markets where women drive demand.

Second, allocation strategy matters. Limited partners already reward firms with balanced leadership because it signals rigour, discipline and broader market awareness. Industry trends have produced sufficient data to back the opportunities that investors are presented with in terms of profitable ROIs with female-led investment firms.

Third, for founders seeking capital, understanding where women sit in the investment ecosystem can materially affect access to funding and strategic alignment.

The World Bank has estimated that closing the gender gap in employment and entrepreneurship could add to the global GDP by 20%, worth over £15.8 trillion. Capital markets sit at the centre of that equation, wielding the power to shift the global economy and close the gender disparity.