Women form the backbone of African agriculture, particularly in Sub-Saharan Africa, where approximately 76% of working women are employed in this sector. They constitute 49% of the agrifood systems workforce, engaging in activities ranging from production and processing to distribution and consumption. Yet their role extends well beyond manual labour. Women play a vital role in shaping agricultural knowledge systems and local sustainability practices. They act as custodians of cultural and ecological knowledge, passing down indigenous land-use practices and understanding of local crops that sustain productivity, protect biodiversity and increasingly support climate resilience. In countries like Nigeria and Somalia, women are increasingly at the forefront of climate adaptation efforts, particularly within displacement-affected communities. In Somalia, over 21,000 women-headed households have gained improved access to water and solar energy, enabling better management of drought and flood impacts. Meanwhile, in Nigeria, initiatives involving more than 32,000 women have restored degraded farmland through rainwater harvesting and improved drainage, leading to a 75% increase in crop yields. These examples are reminders of the critical role women play in enhancing environmental resilience and securing livelihoods in challenging situations.

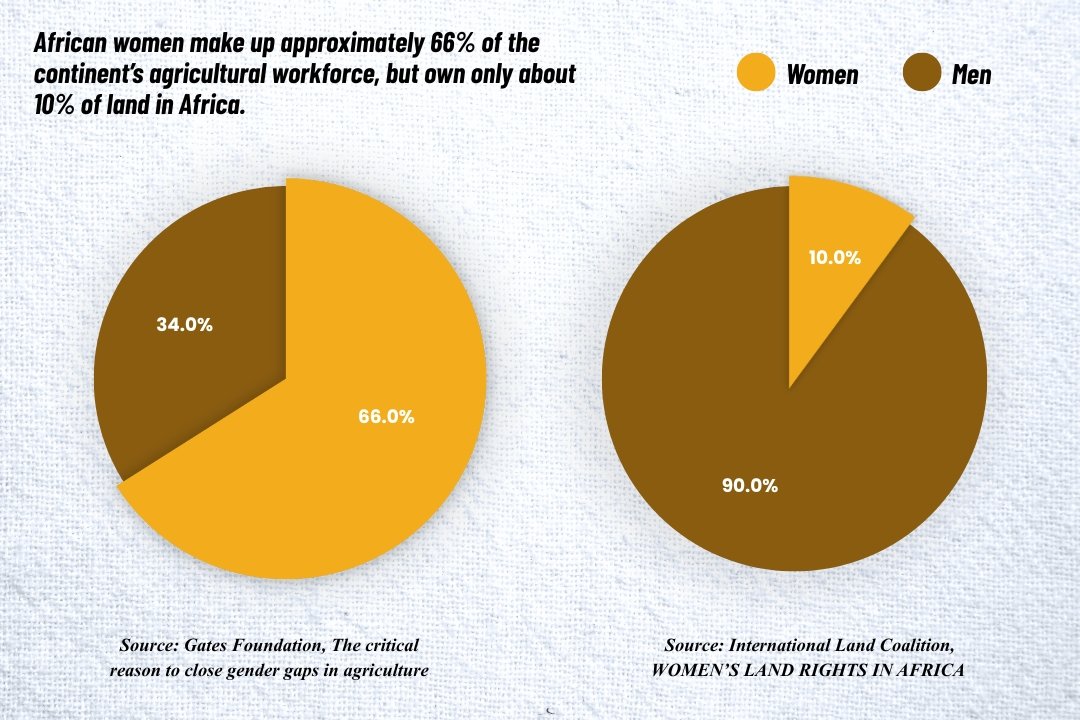

Despite their central position in the sector, women face structural limitations in accessing land, credit, technologies and leadership roles. In today’s economy, equity isn’t optional, it is a core driver of growth and operational strength.

The pathway forward is clear. If women are to become not just participants but key drivers of agricultural transformation, Africa must prioritise structural reforms that translate commitment into tangible outcomes. This means rethinking how resources, technology, and finance are distributed, while embedding gender inclusion at every level of the agricultural value chain. Empowering women in agriculture is no longer a matter of social policy; it is an economic imperative that can unlock productivity, stimulate innovation, and strengthen food security across the continent.

The next step lies in identifying and implementing strategies that address these disparities.

Strategies for reshaping African agriculture to achieve gender equality

Women are central to Africa’s agricultural economy, accounting for 49% of the workforce. Yet they own less than 20% of the land and receive under 10% of available agricultural credit. This imbalance is not only an issue of fairness; it is a missed economic opportunity.

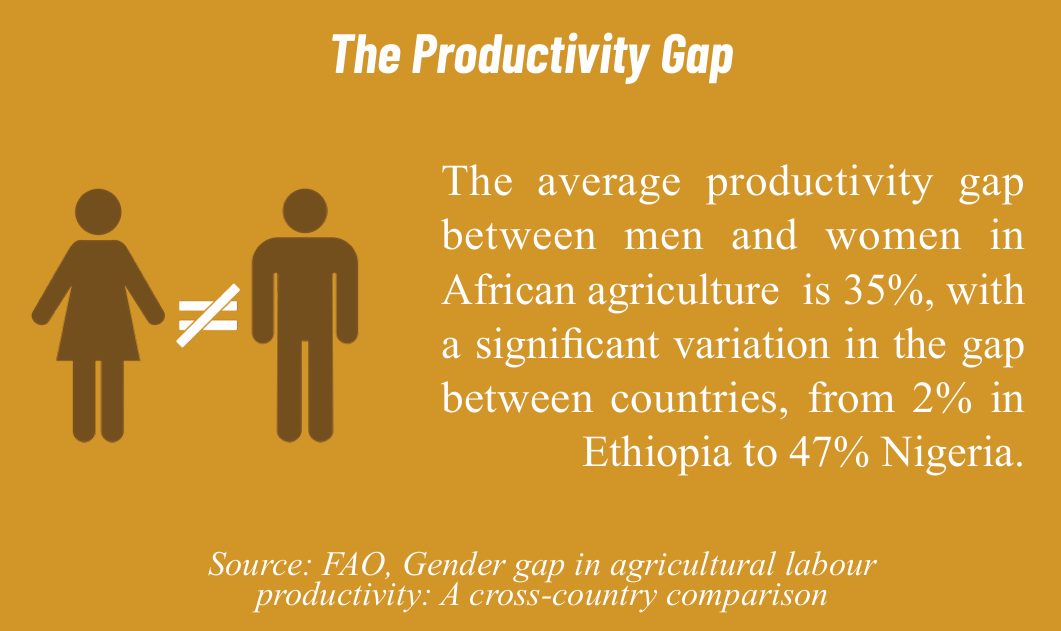

Recent studies indicate that addressing gender disparities in African agriculture could lead to significant economic benefits. For instance, closing the gender gap in Nigeria’s agricultural sector is estimated to boost the country’s GDP by up to US$8.1 billion annually, representing approximately 2% of Nigeria’s GDP.

The following strategies highlight practical ways to make African agriculture more inclusive, drawing on successful initiatives and data-driven insights.

Strengthening women’s land rights

Secure land ownership is the foundation for financial independence and long-term agricultural growth. However, in Sub-Saharan Africa, only 15% of women farmers have legally registered titles. Without these rights, women are unable to use land as collateral or make investment decisions.

Rwanda’s Land Tenure Regularisation (LTR) Programme, launched in 2010, has been a landmark initiative in securing land rights and promoting gender equity. Within three years, the Rwanda Natural Resources Authority registered over 10.7 million parcels out of an estimated 11.5 million, delivering approximately 6.7 million formal titles. The reform also gave women greater influence in household and farming decisions, leading to better crop diversification and higher yields. Similar initiatives are now being implemented in Ghana and Uganda to formalise women’s land ownership and improve access to agricultural finance.

Expanding financial access

Despite their economic role, women farmers continue to face significant barriers to finance. They receive less than 10% of formal agricultural loans, forcing many to depend on informal savings groups. In South Africa and West Africa, community-led savings schemes such as stokvels and tontines play a crucial role in financial inclusion. For example, South African stokvels involve around 11 million participants and collectively manage approximately $2.7 billion (R50 billion) annually.However, these informal systems often lack regulation, provide limited access to credit, and are vulnerable to mismanagement or loss, limiting women’s ability to scale their businesses. Recognizing these challenges, broader initiatives like the Affirmative Finance Action for Women in Africa (AFAWA) are working to bridge this gap by expanding formal financing opportunities for women across the continent.

As of March 2025, the bank through Affirmative Finance Action for Women in Africa (AFAWA), has approved $2.5 billion in financing, with over $1.2 billion already disbursed to women entrepreneurs via a network of 185 partner financial institutions across 44 African countries. To date, more than 24,000 African women have benefited from AFAWA-supported financing and capacity-building programs.

Promoting women-led agribusiness networks

Women’s leadership is increasingly recognised as central to building resilient and inclusive agricultural markets across Africa. AGRA’s VALUE4HER initiative is at the forefront of this effort, equipping women agripreneurs with the tools, networks, and market access necessary to scale their enterprises.

Women’s leadership is increasingly recognised as central to building resilient and inclusive agricultural markets across Africa. AGRA’s VALUE4HER initiative is at the forefront of this effort, equipping women agripreneurs with the tools, networks, and market access necessary to scale their enterprises.

At the heart of the programme is VALUE4HERConnect, Africa’s first digital marketplace and intelligence platform for women-led agribusinesses. The platform now connects over 3,500 businesses across the continent, providing visibility, mentorship, financing opportunities, and market intelligence. Its structured pillars – Women 2 Market, Women 2 Finance, Socio-Capital, Knowledge & Innovation, and Supplier Networks enable women-led enterprises to transition from informal micro-businesses to credible players in competitive value chains.

The initiative’s impact is reinforced by programmes such as the Women Agripreneurs of the Year Awards (WAYA), which in 2024 attracted 1,535 applicants from 44 countries, spotlighting Africa’s most innovative female agricultural leaders. By combining digital connectivity, capacity building, and advocacy, VALUE4HER is shaping the next generation of women leaders, advancing productivity, resilience, and inclusive growth across African food systems.

Harnessing digital financial services

Digital technology has the potential to close financial gaps, yet its reach in rural Africa remains limited. Women are 20% less likely to have smartphones or internet access, limiting their digital resources. Similarly, only 30% of rural women farmers have access to agritech tools, despite over 50% of those with access reporting increased productivity. Poor network coverage, lack of digital skills, and limited trust in formal systems remain major obstacles.

Where digital inclusion has been prioritised, the results are transformative. Kenya’s M-Pesa platform has significantly increased women’s access to financial services, with over 45% of its lending directed towards women. This initiative has empowered approximately 185,000 women to transition from subsistence farming to business and retail occupations, thereby lifting them out of extreme poverty.

Additionally, M-Pesa has played a crucial role in enhancing financial inclusion in Kenya. By 2024, M-Pesa had over 66 million customers, with half of them being women. The platform’s impact is evident in the increased access to formal financial services, rising from 75% in 2016 to 84% in 2021. These outcomes highlight the profound impact of prioritizing digital inclusion, particularly in empowering women and strengthening economic growth.

Mobile money platforms like MTN MoMo, TymeBank, and Capitec have expanded women’s access to financial services in rural and semi-urban Africa, overcoming barriers such as distance, cost, and lack of documentation. These platforms enable women to save, receive remittances, run businesses, and participate in mobile savings groups, improving financial transparency and helping build formal credit histories. In Kenya and Ghana, such tools have directly supported women’s economic empowerment and household income.

Making public–private partnerships gender responsive

Public–private partnerships (PPPs) often fail to benefit women small-scale farmers when they are not intentionally designed to address gender barriers. In South Africa’s Eastern Cape citrus project, women held 0% of cooperative board seats and 0% of PPP steering committee positions, received training but had no control over budgets, procurement, or contracts, and lacked land or collateral to access formal credit. Most relied on informal savings groups, which do not contribute to credit histories. Without gender quotas and leadership roles, PPPs risk perpetuating structural barriers, preventing women from turning skills into business growth. Tracking loans, training, and leadership by gender is crucial to ensure equitable benefits.

Reducing the burden of unpaid care work

Women’s productivity in agriculture is heavily affected by unpaid household responsibilities. In Burundi, women work an average of 13 hours per day, with 7 hours spent on productive labor and 6 hours on unpaid care work, while men spend roughly 7 hours on paid work.

Programs like PlantwisePlus by CABI aim to strengthen agricultural systems and build capacity in plant health, indirectly supporting women farmers by improving access to agricultural resources and knowledge. Reducing the burden of unpaid care through investment in rural infrastructure such as childcare, water supply, and energy systems can free up women’s time for productive work, boosting agricultural productivity, income, and overall economic growth.

Building skills and confidence

Access to finance alone does not guarantee success. Training and mentorship are crucial in helping women sustain and scale their businesses. Tailored entrepreneurial coaching – covering leadership, negotiation, and market strategy, builds confidence and strengthens long-term business performance.

The International Finance Corporation (IFC) partnered with the agribusiness giant Cargill to empower women with entrepreneurial and leadership training. This project, known as Coop Academy 2.0, aimed at facilitating sustainable livelihoods for female farmers in the company’s supply chain in Côte d’Ivoire. Amongst the 2029 women that were trained under this project, 77% were able to improve their monthly income. 42% of these women increased their income by selling agricultural products. 36% of women who were trained under this program were also able to lift themselves out of extreme poverty.

IFC also partnered with Grainpulse Ltd. to increase the productivity of Ugandan smallholder farmers, and half of those reached were women. As a result of this project, female smallholder farmers earned $2.8 million from their crop sales to Grainpulse, comprising 40% of the total earnings of all farmers from such sales.

A business imperative for growth

Gender equity in agriculture is increasingly viewed as an economic priority rather than a social goal. McKinsey estimates that women’s economic participation could add up to US$287 billion to Africa’s GDP, a 5% increase and create 23 million jobs.

For investors and business leaders, inclusive agribusiness models deliver tangible benefits: higher loan repayment rates, stronger governance, and better alignment with ESG goals. For policymakers, ensuring women’s equal access to land, finance, and digital tools is essential to securing Africa’s food systems and rural economies.

Women farmers are not peripheral contributors to Africa’s agricultural success—they are its driving force. Unlocking their full potential will determine not only the future of African agriculture but also the continent’s broader economic resilience.