Northern Star Resources announced that it has agreed to buy De Grey Mining in an all-stock deal valued at about 5 billion Australian dollars (US$3.26 billion).

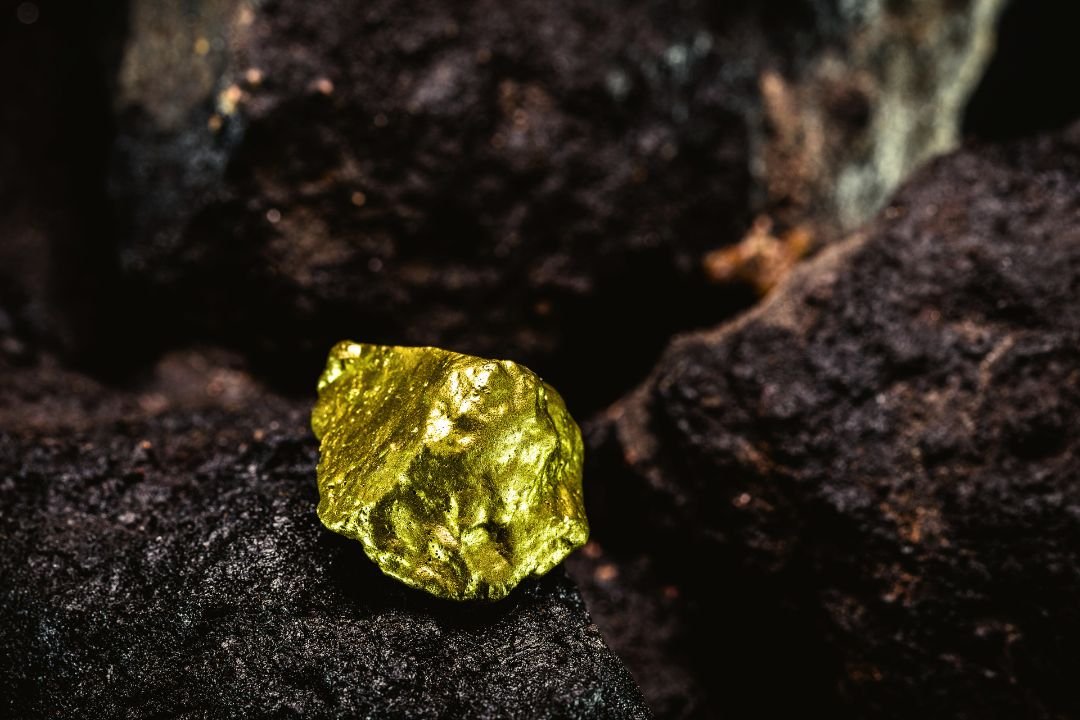

Northern Star, which runs gold-mining operations in Australia and the U.S., has been expanding production under a five-year strategy it laid out in mid-2021 to be producing two million troy ounces of gold a year, or roughly 25% more, by fiscal 2026.

Valued at more than A$20 billion, the company is already Australia’s biggest listed gold miner. De Grey’s flagship project, Hemi, is a low-cost, long-life and large-scale gold project in the mineral-rich Pilbara region of western Australia, said Northern Star Chief Executive Stuart Tonkin.

The deals have been struck against a backdrop of strong gold prices, which surged as investors sought a hedge against geopolitical turbulence. The U.S. election and bets on interest-rate cuts also lured investors to buy the metal. For the first time, the price of a standard gold bar topped US$1 million.

Under the terms of the deal, De Grey shareholders would get 0.119 new Northern Star share for each De Grey one they hold, representing an implied offer price of A$2.08 a share and a 44% premium to De Grey’s 30-day volume-weighted average price.

Northern Star shareholders would own approximately 80% of the combined group, and De Grey shareholders the rest. The transaction has been unanimously recommended by directors of De Grey.